The purpose of the AAT Level 2 Certificate in Accounting is to offer grounding in the core accounting knowledge and skills needed to progress either to employment or to further study. This qualification is suitable for young people who have just left school as well as for adults returning to work after a break or for anyone wishing to change career.

The Level 2 Certificate in Accounting is the AAT’s entry-level qualification. Under Q2022 this level is made up of four modules in bookkeeping and finance:

Introduction to Bookkeeping (ITBK)

This unit introduces students to the double-entry bookkeeping system and the associated documents and processes. Students will have learnt all stages necessary to process transactions using both manual and digital systems.

Principles of Bookkeeping Controls (POBC)

This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals, and reconciliations. It takes students through a number of processes used in bookkeeping that help verify and validate the entries made. Students will also understand the use of the journal to the stage of redrafting the trial balance, following initial adjustments.

Principles of Costing Techniques (PCTN)

This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions, and control costs.

The Business Environment Synoptic (BESY)

The synoptic assessment will ask students to apply knowledge and skills gained across the level 2 qualification in an integrated way, within a workplace context. This course provides the learning materials for the Business Environment unit and revision materials for the bookkeeping units.

We have invested in developing, what we feel is the next generation of learning resources for AAT Q2022.

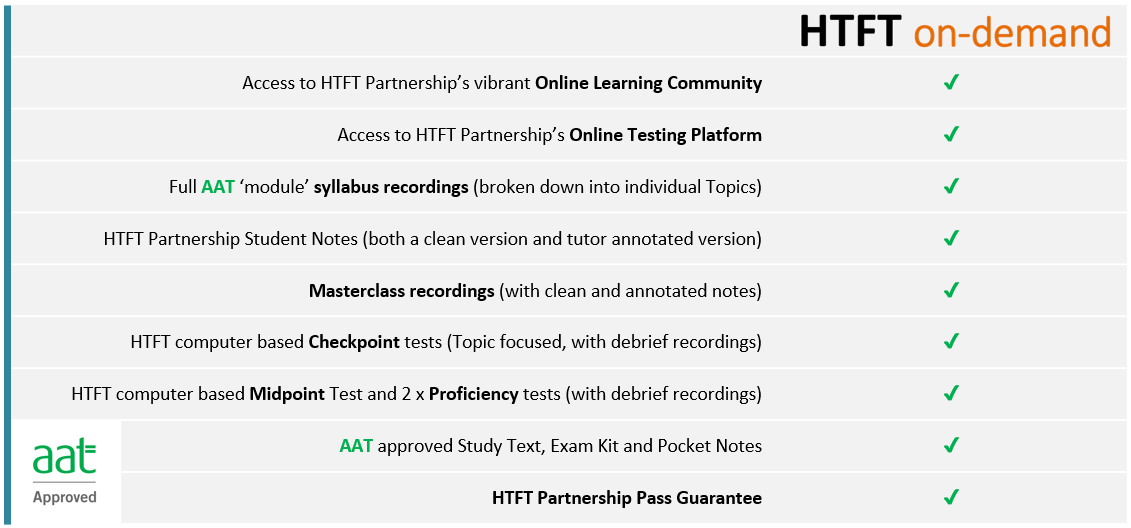

Specifically for the AAT Level 2 Certificate in Accounting we have an on-demand offering:

Our on-demand means you can access content anywhere and at any time. You drive the pace of your learning, completing the content in a timeframe that works for you.

Our delivery model for AAT is based on the flipped classroom methodology.

That is, we provide you with a series of pre-recorded AAT Topic related bite size videos which go through, explain and illustrate the syllabus being examined. After each Topic there is a Checkpoint (online assessment with instant results) to test what you have just learnt, allowing you to track your learning, analyse your performance and identify any areas you need to revisit.

We ask you to watch these Topic recordings and complete the Checkpoints before you engage with our recorded Masterclass content (videos focusing on application of knowledge) that are integrated into your overall schedule of work.

You will have access to our on-demand resources for 6 months from date of enrolment.

In addition to all of the HTFT Partnership created content and resources, we send out the AAT approved Study Text, Exam Kit and Pocket Notes – which you can use as additional study resources.

Short qualifications – AAT Q2022 – Level 2 Certificate in Bookkeeping

The purpose of the Level 2 Certificate in Bookkeeping is to ensure students have the solid bookkeeping skills necessary for most finance roles. Students will develop practical accountancy skills in the double-entry bookkeeping system and in using associated documents and processes, as well as dealing with VAT and trail balances while developing their understanding of the relationship between various accounting records.

Alternatively, students can complete the Level 2 Certificate in Bookkeeping qualification, which comprises the two bookkeeping exams (ITBK and POBC), and then progress directly to the Level 3 Diploma in Accounting. This qualification takes between 2 months and 6 months to complete.