The purpose of the AAT Level 4 Diploma in Professional Accounting is to enhance the skills developed from the AAT Level 3 Diploma in Accounting qualification, enabling students to maximise opportunities in their current or new employment. By studying for this qualification students will acquire lifelong professional accountancy and finance skills.

This qualification comprises three mandatory units and two optional units from a choice of five, which cover complex accounting and finance tasks.

The Level 4 Diploma in Professional Accounting comprises three compulsory units:

Drafting and Interpreting Financial Statements (DAIF)

This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. Students will also acquire the tools and techniques required to analyse and interpret financial statements using ratio analysis.

Applied Management Accounting (AMAC)

This unit focuses on the three fundamental areas of management accounting: planning, control and decision making. All organisations rely on the provision of accurate, business-focused information in order to make sound business judgements.

Internal Accounting Systems and Controls (INAC)

The key aim of this unit is to provide students with the tools to evaluate internal controls and to recommend improvements. Students will learn to identify appropriate controls, assess their impact in terms of cost-effectiveness, reliability, and timeliness, and ensure that all functions adapt their working practices to meet new requirements in an ethical and sustainable way.

and two optional units (from a choice of five):

Business Tax (BTNA)

This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards.

Personal Tax (PTNA)

This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: income tax, capital gains tax, and inheritance tax. With this knowledge, students will be equipped to prepare not only the computational aspects where appropriate of these taxes, but also appreciate how taxpayers can legally minimise their overall taxation liability.

Audit and Assurance (AUDT)

This unit aims to develop a wider understanding of the principles and concepts, including the legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report.

Cash and Financial Management (CSFT)

This unit focuses on the importance of managing cash within organisations and covers the knowledge and skills required to make informed decisions on financing and investment in accordance with organisational policies and external regulations.

Credit and Debt Management (CRDM)

This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. This unit will consider the techniques that can be used to assess credit risks in line with policies, relevant legislation, and ethical principles. Students will also consider what techniques are used to enable the collection of any overdue debts.

We have invested in developing, what we feel is the next generation of learning resources for AAT Q2022.

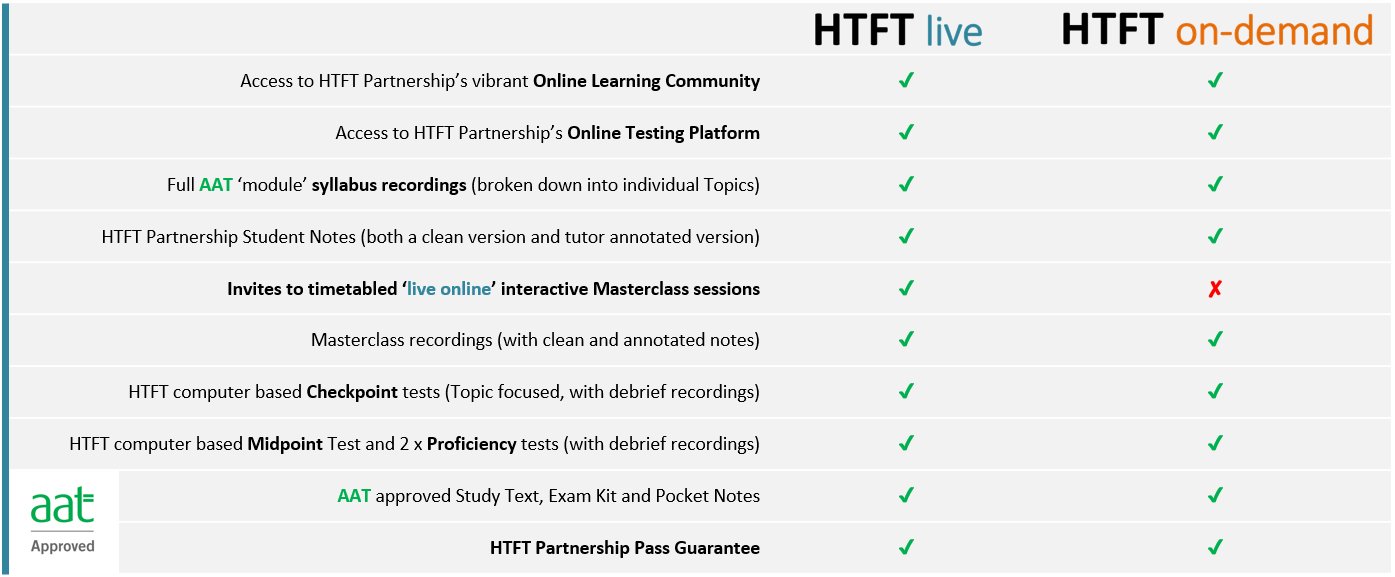

Specifically for the AAT Level 4 Diploma in Professional Accounting we have a live and on-demand offering:

Our delivery model for AAT is based on the flipped classroom methodology.

That is, we provide you with a series of pre-recorded AAT Topic related bite size videos which go through, explain and illustrate the syllabus being examined. After each Topic there is a Checkpoint (online assessment with instant results) to test what you have just learnt, allowing you to track your learning, analyse your performance and identify any areas you need to revisit.

We ask you to watch these Topic recordings and complete the Checkpoints before you engage with our recorded Masterclass content (videos focusing on application of knowledge) that are integrated into your overall schedule of work.

In addition to all of the HTFT Partnership created content and resources, we send out the AAT approved Study Text, Exam Kit and Pocket Notes – which you can use as additional study resources.

live

Our live course means you follow a set timetable and attend online sessions 6:30-8:45pm midweek. We expect you to work through the relevant Topic recordings and Checkpoints in preparation for these Masterclasses. The timetabled live Masterclasses (timetables on the right hand side) is time with your dedicated tutor focusing on an application of knowledge and question practice, rather than re-teaching you content you will have developed by watching the pre-recorded videos.

on-demand

Our on-demand means you can access content anywhere and at any time. You drive the pace of your learning, completing the content in a timeframe that works for you.

You will have access to our on-demand resources for 6 months from date of enrolment.

*With HTFT on-demand you get immediate access to pre-recorded Topic videos covering syllabus content, in addition to be provided with the recordings of any live Masterclasses that take place 24 hours after the live timetabled dates.