The Certificate in Business Accounting is CIMA’s entry level accounting qualification for students with little or no accounting background.

The certificate level gives you business experience beyond just financial accounting and you’ll gain insight into how the different areas of accounting relate to the business world.

It can be seen as a knowledge refresher course or a foundation to a career in business and finance. The Certificate in Business Accounting forms the basis of the CIMA Professional Qualification and is a valuable qualification on its own.

CIMA's Certificate in Business Accounting comprises four exams, as outlined below:

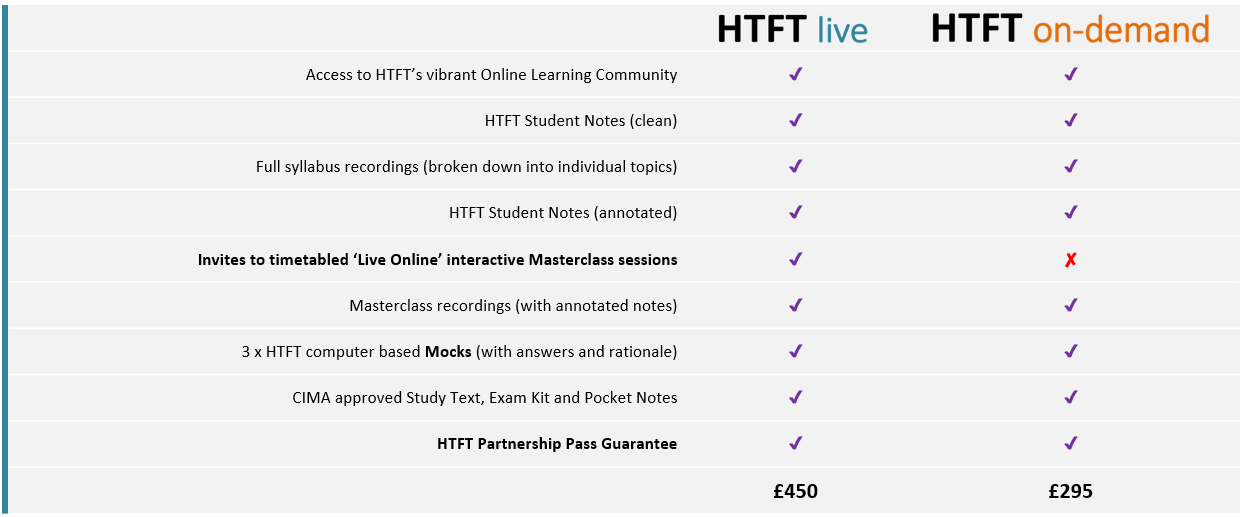

We have develop two packages for the CIMA Certificate Objective Test exams:

- HTFT live: scheduled live online sessions, supported by topic recordings, to guide you through

- HTFT on-demand: engage with the full suite of HTFT resources, at your pace